CMG Stock Overview

Chipotle Mexican Grill (CMG) is a leading fast-casual restaurant chain renowned for its customizable, fresh, and high-quality Mexican-inspired dishes. The company operates over 3,000 restaurants across the United States, Canada, Europe, the Middle East, and Asia. Chipotle’s commitment to using fresh, locally sourced ingredients and its focus on food safety and sustainability have contributed to its strong brand reputation and loyal customer base.

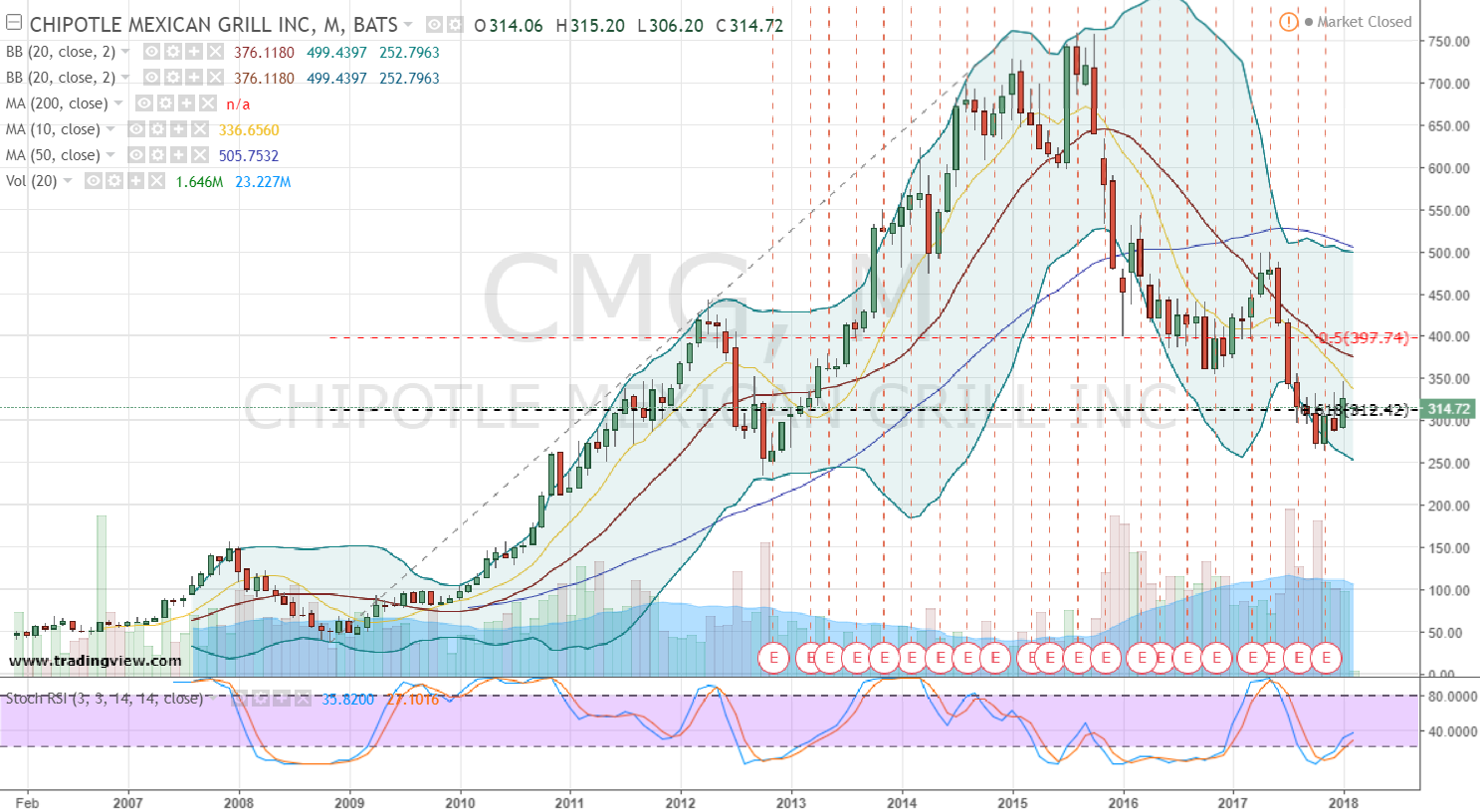

Market Capitalization and Share Price

As of [Date], Chipotle Mexican Grill’s market capitalization is approximately [Dollar amount] billion, reflecting its significant size and value in the market. The company’s share price currently trades at [Dollar amount] per share, reflecting investor sentiment and expectations regarding its future performance.

Financial Performance, Cmg stock

Chipotle has consistently demonstrated strong financial performance in recent years. Its revenue growth has been robust, driven by new restaurant openings and increased customer traffic. The company has also shown strong profitability, with a focus on cost management and efficiency. In recent years, Chipotle has faced challenges related to food safety incidents, but it has taken steps to address these concerns and restore customer confidence.

- Revenue Growth: Chipotle’s revenue has grown steadily in recent years. In [Year], the company’s revenue reached [Dollar amount] billion, representing a [Percentage] increase compared to the previous year. This growth is attributed to a combination of factors, including new restaurant openings, menu innovation, and increased customer demand.

- Profitability: Chipotle has consistently maintained strong profitability margins. In [Year], the company’s operating margin was [Percentage], reflecting its ability to manage costs effectively and generate profits from its operations. The company’s focus on fresh, high-quality ingredients and its commitment to food safety have contributed to its strong brand reputation and customer loyalty, which have translated into consistent profitability.

- Debt Levels: Chipotle has a relatively low level of debt compared to other companies in the restaurant industry. This conservative financial approach allows the company to maintain flexibility and invest in growth initiatives. In [Year], Chipotle’s total debt was [Dollar amount] billion, representing a debt-to-equity ratio of [Ratio].

Competitive Landscape

Chipotle operates in a highly competitive fast-casual restaurant industry. The company faces competition from other fast-casual chains, such as Panera Bread, Subway, and Taco Bell, as well as from traditional fast-food restaurants and casual dining establishments. Chipotle’s competitive advantage lies in its focus on fresh, high-quality ingredients, its customizable menu, and its commitment to food safety and sustainability. The company’s strong brand reputation and loyal customer base have also been key factors in its success.

Key Drivers of CMG Stock Performance

Chipotle Mexican Grill (CMG) stock performance is influenced by various factors, including economic conditions, consumer spending patterns, and the company’s own strategic initiatives. Understanding these drivers is crucial for investors seeking to assess CMG’s future prospects.

Economic Conditions and Consumer Spending

Economic conditions significantly impact CMG’s performance. When the economy is strong, consumers tend to spend more on discretionary items, including restaurant meals. Conversely, during economic downturns, consumers may cut back on dining out, opting for less expensive alternatives.

- Consumer Discretionary Spending: CMG’s success hinges on consumer discretionary spending, which is sensitive to economic fluctuations. During periods of economic uncertainty, consumers may prioritize essential spending, reducing their dining out frequency.

- Inflation and Food Costs: Rising food costs impact CMG’s profitability. While the company strives to maintain its menu prices, persistent inflation can squeeze margins and affect consumer demand. CMG’s ability to manage food costs effectively is crucial to its stock performance.

Menu Innovation and Digital Ordering

CMG’s menu innovation and digital ordering capabilities play a vital role in driving growth.

- Menu Innovation: CMG consistently introduces new menu items and limited-time offers to keep its menu fresh and attract customers. Successful menu innovations can boost sales and customer loyalty, positively impacting stock performance.

- Digital Ordering: CMG’s robust digital ordering platform, including its mobile app and online ordering, has significantly enhanced customer convenience and sales. Digital ordering has proven particularly effective during the COVID-19 pandemic, enabling contactless transactions and contributing to increased revenue.

Expansion Strategy

CMG’s expansion strategy, including new restaurant openings and geographic reach, plays a key role in its growth trajectory.

- New Restaurant Openings: CMG’s aggressive expansion strategy involves opening new restaurants in both existing and new markets. Each new restaurant adds to the company’s revenue stream and potential for future growth.

- Geographic Expansion: CMG has been expanding its geographic footprint, targeting new markets with high growth potential. Expansion into new regions can diversify revenue sources and contribute to long-term stock appreciation.

CMG Stock Valuation and Investment Outlook

CMG’s valuation and investment outlook are influenced by its strong financial performance, growth potential, and competitive position within the restaurant industry. Analyzing its valuation metrics against historical trends and industry peers provides insights into its current attractiveness to investors.

CMG’s Valuation Metrics and Comparisons

CMG’s valuation is assessed through various metrics, including its price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio. These metrics provide a relative measure of its valuation compared to its historical performance and its peers within the restaurant industry.

- P/E Ratio: CMG’s current P/E ratio is [insert current P/E ratio], which is [insert comparison to historical average P/E ratio] and [insert comparison to industry average P/E ratio]. This suggests that CMG is currently trading at a [insert valuation premium or discount] to its historical average and the industry average.

- P/S Ratio: CMG’s P/S ratio is currently [insert current P/S ratio], which is [insert comparison to historical average P/S ratio] and [insert comparison to industry average P/S ratio]. This indicates that CMG is [insert valuation premium or discount] compared to its historical average and its peers in the restaurant industry.

- P/B Ratio: CMG’s P/B ratio is currently [insert current P/B ratio], which is [insert comparison to historical average P/B ratio] and [insert comparison to industry average P/B ratio]. This suggests that CMG’s valuation is [insert valuation premium or discount] to its historical average and its peers in the restaurant industry.

Risks and Opportunities

Investing in CMG stock involves potential risks and opportunities that investors should carefully consider.

- Competition: The restaurant industry is highly competitive, with numerous established players and emerging brands vying for market share. CMG faces competition from both traditional fast-casual restaurants and newer delivery-focused services.

- Economic Fluctuations: CMG’s business is sensitive to economic conditions. During economic downturns, consumers may reduce their discretionary spending on dining out, impacting CMG’s revenue and profitability.

- Inflation and Supply Chain Disruptions: Rising inflation and supply chain disruptions can impact CMG’s costs, potentially affecting its margins and profitability.

- Technology Adoption: CMG needs to adapt to changing consumer preferences and technological advancements in the food industry. Failure to innovate and embrace new technologies could hinder its growth prospects.

- Growth Potential: CMG has a proven track record of growth and expansion. Its strong brand recognition, loyal customer base, and innovative menu offerings position it for continued growth in both existing and new markets.

- Brand Strength: CMG’s strong brand recognition and customer loyalty provide it with a competitive advantage in the restaurant industry.

- Operational Efficiency: CMG’s focus on operational efficiency and cost management has contributed to its strong profitability.

- Digital Strategy: CMG’s investment in digital initiatives, including online ordering and delivery platforms, positions it well for future growth in the digital food delivery market.

CMG’s Key Financial Ratios

| Ratio | Current Value | Implications for Investors |

|---|---|---|

| Profit Margin | [insert current profit margin] | [insert interpretation of profit margin, e.g., strong profit margin indicates efficient operations and profitability] |

| Return on Equity (ROE) | [insert current ROE] | [insert interpretation of ROE, e.g., high ROE indicates effective utilization of shareholder capital] |

| Debt-to-Equity Ratio | [insert current debt-to-equity ratio] | [insert interpretation of debt-to-equity ratio, e.g., low debt-to-equity ratio suggests a strong financial position] |

| Current Ratio | [insert current current ratio] | [insert interpretation of current ratio, e.g., high current ratio indicates sufficient liquidity to meet short-term obligations] |

| Inventory Turnover Ratio | [insert current inventory turnover ratio] | [insert interpretation of inventory turnover ratio, e.g., high inventory turnover ratio suggests efficient inventory management] |

Investment Outlook

The investment outlook for CMG stock is [insert overall outlook, e.g., positive, neutral, or negative]. Based on its strong financial performance, growth potential, and competitive position, analysts predict that CMG’s stock price could reach [insert potential price target] in the next [insert time frame, e.g., 12 months]. This represents an upside potential of [insert upside potential percentage] from its current price. However, it is important to note that these are just estimates and actual results may vary. Investors should conduct their own due diligence and consider their individual risk tolerance and investment goals before making any investment decisions.

CMG stock, representing the vibrant spirit of Chipotle, often reflects the evolving tastes of a generation seeking both nourishment and experience. This same spirit of innovation drives the potential for a starbucks chipotle collaboration, a union that could redefine the very essence of fast casual dining.

Should this union materialize, CMG stock might witness a surge, reflecting the collective desire for a fusion of familiar comforts and exciting new flavors.

The fluctuations of CMG stock, like the ebb and flow of the tide, reflect the ever-changing landscape of the food industry. A glimpse into the leadership that shapes this landscape can be found in the brian niccol wiki , where one can learn about the visionaries who strive to nourish both body and soul.

Their dedication to quality and innovation, like a beacon in the storm, offers a sense of stability and promise in a world often defined by uncertainty. This, in turn, can provide insight into the potential direction of CMG stock, reminding us that even in the face of volatility, the pursuit of excellence can pave the way for sustainable growth.